Your Money or Your Life by Vicki Robin — Book Summary

Summary, Notes & Highlights

This book completely changed my relationship with money. Presented as a personal finance book, it answers much deeper questions than just "How can I save more?" Happiness, life purpose, money mindset and much more…

1. QUICK NOTES

Hang money goals on the wall 100k, 2million, 1000/day. Jim Carry put 1million pay day on his wall

Become a Super Saver. Look at SAVING like a game, the more your safe the better, with every step you become better at this game.

Always adjust to save More. Ex. Get a roommate = brings you 4 years faster to your goals OR go for a dinner just once a month instead of 2-3. it’s about the Little things that add up

The sooner you start, the more you’ll have it’s as simple as that

Taking Care of Your Body, prevention is key. Health, working out, healthy food, preventive visits at the doctor

There is nothing in your life that is more valuable than your time, the moments you have left. Separating work from wages means all moments in your life matter, and reclaiming more moments to spend as you will, not as you must, is a worthy goal indeed.

Do you experience more stress when you have money, or when you don’t have it? Finish the sentence “If I had more money, then I’d be . . .” Elaborate! Are you earning what you’re worth? What belief about money keeps you from being, doing, or having what you want?

Learn about your money behavior by keeping track of every cent that comes into and goes out of your life.

Vacations/Nights out/Trip = often used away from a Heavy week at Work Escape from what? What is the prison or restrictive circumstance from which you must flee? Would these be necessary? Why is it just a time out to get back to work? Could it be something meaningful? Instesd of a Bahamas Trip, you devote some time to help the Local community. That’s living not a vacation. This shows me how important it is to find some meaningful work that you truly love, have a passion for it

Financial Independence has nothing to do with rich. It is the experience of having enough—and then some.

What is “rich”? Rich exists only in comparison to something or someone else.

„men do not desire to be rich, only to be richer than other men.” — John Stuart Mill

heal the split between their money and their life, and life becomes one integrated whole.

2. 9 STEP MONEY PROGRAMM

Making Peace with the past. find your net worth track all assets and liabilities

Being in the present, tracking your life energy

where is it all going? monthly expense tracking

Questions That Will Transform Your Life (Spending)

Did I receive fulfillment, satisfaction, and value in proportion to life energy spent?

Is this expenditure of life energy in alignment with my values and life purpose?

How might this expenditure change if I didn’t have to work for money?

Making life energy visible. show your expenses, goals on a wall/online

Valuing your Life Energy - minimizing spending. lower expenses, increase savings

Valuing your Life Energy - maximizing income. money = you trade your life energy for. trade it with purpose for increased earnings

capital and the crossover point

investing for financial freedom

evaluate your spending by asking three questions about the total money spent in each of your subcategories

3. LONG-TERM FINANCIAL INVESTMENTS

Income

5 ways your can earn investment income

Interest rate from fixed income invested

Dividends

Capital gains = sale of investments, real estate

rents = from owned real estate

royalties = payments to owners, intellectual property, natural recourses, franchise

Real Estate multifamily building

buy duplexes, triplexes, quads if you have the buying power. tenants take care of your home and paying you for it.

Checklist evaluating multifamily building

property in a location that you are comfortable with being a part of your life for the next few years, or indefinitely?

Is the property in a location that you believe has good prospects? Is it likely to appreciate? Is the neighborhood likely to stay attractive and safe?

What is the property expected to generate in terms of gross rent?

What are the expected expenses? Common ones are repairs, utilities, any homeowners association fees, taxes, capex (capital expenses), those months between tenants when units are vacant, and any management fees if you don’t choose to do it yourself. This adds up to needing a substantial kitty—in the tens of thousands—going into the purchase.

4. QUESTIONS FOR DAILY REFLECTIONS - MONEY MINDSET

What ideas (practical and wild) do you have about how you pay off all your debt?

What do you want your legacy to be?

If you didn't have to work for a living, what would you do with your time?

If you could take a year off work, how would you spend it?

What skills or social networks could you build now to depend less on money to meet your needs?

5. 4% RULE MONTHLY PASSIVE INCOME

capital X current longterm interest rate / 12 Month = monthly investment income

100€ X 4% / 12 = 0,33€ month

1000€ X 4% / 12 = 3,33€ month

The original investment (100€) isn't touched. think of it as small monthly income. Use it for small things like coffee or phone bill. How does it make you feel earning nice little income every month for doing nothing?

6. REDEFINING WORK INCREASES CHOICES

Is your Job just something you do for a living to pay the checks Or your true purpose?

Being able to acknowledge who you really are allows you to reevaluate how you’ve structured your “career.”

“I am a teacher, but currently I’m writing computer programs to make money.” (This focuses on your true purpose, teacher, education)

When you break the link between wages and work other opportunities opens up

7. HOW TO DEAL WITH UNUSUAL, UNEXPECTED, BAD EXPENSES

recognize that every month is an unusual month. learn to take “unusual” expenses in steps and to pay for them with cash instead of hiding them under Pillow

Strategy = divide annual expenses by 12, make it a monthly costs. Ex. yearly auto insurance bill 800€/12 = 66,66€/month

Same with health insurance, income tax payments, property taxes, and so on

8. HOW TO FIND YOUR LIFE PURPOSE

What is purpose?

Purpose implies direction and time—you do something now to have something later that you value. Ex. enjoy and raising a loving family or something else for

How Do We Find Our Purpose?

Work with your passion, on projects you care deeply about

What would you do Even if you weren’t paid for it?

What would you do if you financial independent and don’t have to work anymore?

9. LIFE ENERGY VS. EARNINGS: WHAT IS YOUR REAL HOURLY WAGE?

life-energy-to-earnings ratio in an unrealistic and inadequate way: “I earn a 1000 Dollars a week, I work 40 hours a week, so I trade 1 hour of my life energy for 25 dollars.” life energy are directly related to your money-earning employment. if you didn’t need that money-earning job, what time expenditures and monetary expenses would disappear from your life?

selling an hour of your life energy for $10, not the apparent $25. Your real hourly wage is $10—before taxes. Are you willing to accept a job that pays this hourly wage?

Example: Is a spending category, product or service of 80$/month worth selling 8h (full day of work) of your life’s energy?

calculation: Money spent on magazines / (divided) Real hourly wage = Hours of life energy. 80$/10$=8H

e.g of a person “After I analyzed our spending patterns, it became clear that nearly half of what I made was spent on the job; that is, spent on gas, oil, repairs, lunches, a little here, a little there, and most of it unrecoverable. In short, I could stay home, work part-time where I live, and actually save money by making half of what I formerly made.”

10. MONEY = LIFE ENERGY

Money is something we choose to trade our life energy for. How much hours of your life will you Invest to have money in your pocket?

money is something you consider valuable enough to devote easily a quarter of your allotted time on earth getting, spending, worrying about, fantasizing about, or in some other way reacting to

You “pay” for money with your time. You choose how to spend it.

11. VALUING YOUR LIFE ENERGY - MINIMIZING SPENDING

Stop Trying to Impress Other People. If you must, impress people with how much money you saved with your creative DIY project or low budget travel hack

Don’t Go Shopping. Resist impulsive buys and withstand the short rush of happiness after purchase

Live Within Your Means. Buy only what you can prudently afford, to avoid debt unless you have an assurance that you will be able to pay it promptly, and to always have something put away for a rainy day.

Take Care of What You Have. Ex take care of your health = saves money in the long run.

Wear It Out. how much money you would save if you simply decided to use things even 20 percent longer? If you buy something ask Yourself do I already have one of these that is in perfectly usable condition? Reuse, repurpose, sell or give away old stuff. Buying running shoes on sale is cheaper than knee surgery

Do It Yourself.

Anticipate Your Needs. Write down your anticipated needs in the next few years and track their price to get the best deal. Get last years car, phone. Helps to avoid impulsive buys

Research Value, Quality, Durability, Multiple Use, and Price. Does a product have a multipurpose? Do I buy a product that is 10€ more but lasts 5years longer? Do I use it on a regular basis?

Buy It for Less. Bargain, haggle with price and ask for discounts on every purchase, your have nothing to lose. Buy second hand, used

Meet Your Needs Differently. Do you Just have one strategy or many different ones to fulfill your needs? Ex. Freedom is a basic need. But if freedom = travel, what are you looking for? Something new, stimulation, getting out of daily habits? New language, culture, different food, reading?

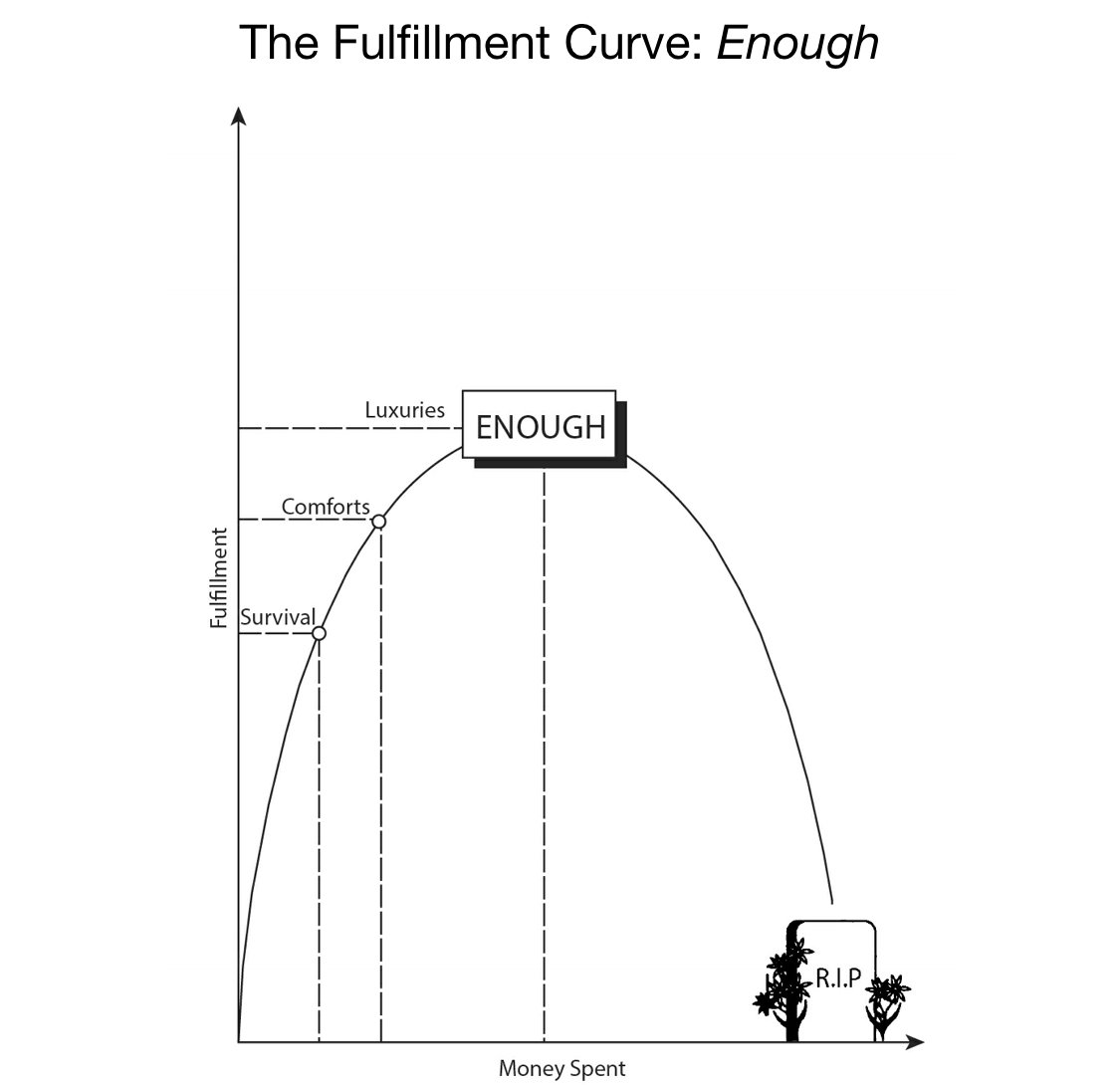

12. THE FULFILMENT CURVE

Consumer

rising expectations have outstripped our incomes, leaving the average consumer-patriot increasingly in debt. → The only way for us to exercise our economic patriotism is to go deeper into debt. We are in a no-win situation. You’re wrong if you buy and wrong if you don’t.

We buy everything from hope to happiness. We no longer live life. We consume it

With the intrusion of the Internet and smartphones into every waking moment of our lives, we can be consumers wherever and whenever. From desire to delivery, almost anything we want is only a few swipes, taps, or clicks away. What was once a privilege for the few now seems like a right for the Masses

Marketing theory says that people are driven by fear, by the promise of exclusivity, by guilt and greed, and by the need for approval. Advertising technology, armed with market research and sophisticated psychology, aims to throw us off balance emotionally—and then promises to resolve our discomfort with a product.

13. MINDSET MONEY & WORK

Is that real life? Going to work, arguing with the boss, talking to colleagues, getting up in the morning and driving to work, standing in traffic jams or cramped on the train, washing, watching TV, posting food photos, answering stacks of emails, getting angry with customers, checking social media for hours?

we think we work to pay the bills—but we spend more than we make on more than we need, which sends us back to work to get the money to spend to get more stuff—that sends us back to work again!

increase free time by reducing expenses and the amount of time on the job.

karoshi (death by overwork, Japan)

stop buying way out of problems and instead use these challenges as opportunities to learn new skills.

increasing globalism and corporate mergers, layoffs in every sector from manufacturing to high tech are the new reality

Financial Independence / Retirement: How to you feel if have to work just for a limited time instead of the normal retirement years? Would you still go back to your job? What would you do? How does it feel if you are in your 30 or 40 and have half of your life ahead of you OR you close to retirement and and some extra years to it?

14. HOW TO SAVE WITH CHILDREN’S

Go out into the nature it’s free

Design own cloths, customs for Halloween, party’s

Children’s swap instead of a baby sitter, kids enjoy playing with others you get a free night

Cloth swaps

If you buy kids new stuff think about how to handle it. Giveaway old cloth or think about how they can earn that item

15. FRUGALITY

is enjoying the goodness of getting good value for every minute of your life energy and from everything you have the use of.

Frugality means enjoying what we have.

If you have ten dresses but still feel you. have nothing to wear, you may be a compulsive shopper—the thrill of getting is greater than the joy of having and using. But if you have ten dresses and have enjoyed wearing all of them for years, you are frugal. Waste lies not in the number of possessions but in the failure to enjoy them.

Frugal people, however, make sure to get the full pleasure from everything

Frugality, is also learning to share, to see the world as ours rather than as theirs and mine.

frugality strategy isn’t about downgrading pleasure. It’s about ensuring that I get precisely what I am seeking for less—or nothing at all.

16. DEFINE HOW MUCH IS ENOUGH

What makes you happy?

What’s most important to you?

What values will you never compromise?

If you had $1 million right now, what would you do with your time?

What’s one thing you could get rid of to make yourself happier? (A person doesn’t count.)

Will you ever have enough money to retire?

If someone today erased all your debts, would you dig yourself into that hole again? How or how not?

17. FINANCIAL INDEPENDENCE

how much is enough money for you to have a life you love, now and in the future? Not getting more or less money

anything that frees you from a dependence on money to handle your life

separation from dead-end routines, jobs, relationships, and ways of thinking

independence from crippling financial beliefs, crippling debt, and a crippling inability to manage modern “conveniences.”

18. FINANCIAL INTELLIGENCE

the ability to step back from your assumptions and your emotions about money and observe them objectively

19. FINANCIAL INTEGRITY

by learning the true impact of your earning and spending, both on your immediate family and on the planet

knowing what is enough money and material goods to keep you at the peak of fulfillment—and what is just excess and clutter.

having all aspects of your financial life in alignment with your values.

20. FINANCIAL INTERDEPENDENCE

happiest moments come from love and contribution

more time for what makes life truly meaningful.

Search for a meaningful life

Spending time helping to make the world a better place.

21. FINANCIAL LITERACY

is the possession of the set of skills and knowledge that allows an individual to make informed and effective decisions with all of their financial resources. Understanding basic financial concepts allows people to know how to navigate in the financial system. People with appropriate financial literacy training make better financial decisions and manage money better than those without such training.